ANSWERING KEY FINANCIAL QUESTIONS.

When it comes to comprehensive dentistry, most patients inevitably ask two key questions immediately after they are presented with a dentist’s treatment recommendations:

1. How much is this treatment going to cost?

2. How can I possibly pay for this?

The cost factor associated with comprehensive dentistry is a dilemma for dentists as well as patients. When it comes to offering extensive treatment options, dentists generally ask themselves these questions:

1.

Will my patients really pay this much for

comprehensive dentistry?

2. Can my patients pay for it?

Unfortunately, often (after asking these questions), many dentists assume that the answer to both questions is “no.” And because of that, they avoid diagnosing comprehensively and stick to tooth-by-tooth dentistry.

Not long ago, I spoke with a dentist regarding the comprehensive treatment options in his office. He rarely, if ever, presented comprehensively to his patients. When I queried the dentist about why this was the case, he emphatically responded, “My staff has convinced me that the people in our area just simply can’t and won’t pay for such extensive procedures, so I don’t even offer those options anymore.” His situation is not unique. I often hear this response as I consult with dental practices around the country.

Essentially, it all comes down to money—to the finances—doesn’t it?

Take Money Out of the Scenario

What if I told you that it’s possible to remove the money ‘problem’ from the equation altogether? No, I’m not suggesting that dentists work for free. Of course not! That is neither realistic nor practical to even imagine. However, what I suggest is to consider the following: what if patients could find ways to pay for the treatments they need? Then would you offer them the best treatment options to address their situations? I’m guessing that the answer to this last question is a “yes.” Of course you would! If you knew that patients could pay for the procedures and really wanted the procedures, it seems outlandish that you wouldn’t offer them.

Now you’re probably thinking, “Tawana, this just isn’t possible. Comprehensive treatment is expensive. Most patients don’t have that kind of money to spend on dentistry.”

Well, sure, that’s true—comprehensive treatment costs a patient more money upfront in comparison to tooth-by-tooth dentistry. Many patients probably don’t have access to a lump sum of money to pay for treatment out of their own pockets.

But that doesn’t mean that they don’t have access to resources. There are many different ways that patients can find money to pay for treatments. And it’s the job of the dental office to help patients navigate through these options and find the best ones.

Insurance Is a Jumping-Off Point

Dental insurance is the main avenue that many dental practices focus on for payment. While insurance may be fine and good as a starting point, it can’t be the only method of payment. The reason for that is simple. As Dr. Dick Barnes explained in his article titled, “The Dental Insurance Conundrum” in the Spring 2014 issue of Aesthetic Dentistry, insurance simply does not pay enough to cover the kinds of treatment that most patients require. Insurance should not be considered the only way that people pay for treatment. Instead, insurance should be used to help patients pay for treatment (the key word in this sentence is ‘help’).

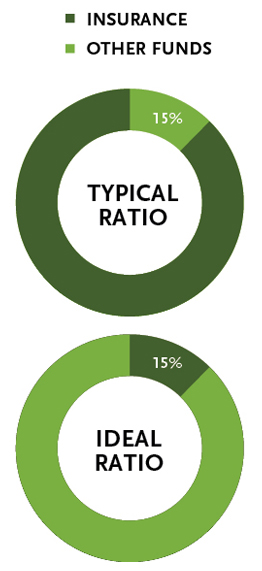

Many offices have about 85 percent of their income generated from insurance companies with only 15 percent of their income generated from other funds. This is not an ideal ratio. When I started working as an office manager at a dental practice in Arkansas, that ratio described the situation in our office. After attending a workshop on this topic, I knew that we were not running our practice productively and we had become an insurance-driven office instead of a care-driven one. I started setting goals for our office to decrease the percentage of money we generated from insurance and increase the percentage of income we generated from other funds. Slowly, we were able to change until eventually we were generating only 15 percent of our income from insurance and 85 percent from other funds. This is the ideal scenario for every practice to shoot for. This ratio benefits not only the dental practice but also the patients.

Many offices have about 85 percent of their income generated from insurance companies with only 15 percent of their income generated from other funds. This is not an ideal ratio. When I started working as an office manager at a dental practice in Arkansas, that ratio described the situation in our office. After attending a workshop on this topic, I knew that we were not running our practice productively and we had become an insurance-driven office instead of a care-driven one. I started setting goals for our office to decrease the percentage of money we generated from insurance and increase the percentage of income we generated from other funds. Slowly, we were able to change until eventually we were generating only 15 percent of our income from insurance and 85 percent from other funds. This is the ideal scenario for every practice to shoot for. This ratio benefits not only the dental practice but also the patients.

Most patients with dental needs cannot wait years to have their dental treatment completed. Unfortunately, that is what often happens if they rely solely on insurance payments. If patients wait years, there could be significant consequences to their dental health. For example, if a patient comes into the office and has five teeth that need to be crowned, his or her insurance benefits are typically only enough for one crown. So if the patient only uses insurance benefits for treatment, he or she will wait around five years for all five teeth to be done! One can only hope that the teeth left untreated during that time do not break and abscess.

Let’s look at this patient’s situation from another perspective—one that is both beneficial to him or her and the dental practice. Let’s imagine that the patient takes advantage of dental insurance. That knocks about $1,500 off the total cost of his or her treatment. Then, the patient takes the remaining balance and pays for it using some creative financing options which were presented by the dental office’s financial coordinator. By handling the situation this way, the patient can get the treatment that he or she needs right away, and the dental practice is also able to establish a productive and predictable schedule.

Help Patients Find Funding

In my opinion, the very worst thing that a dental practice can do is to present treatment to patients, tell them the total amount that it will cost, and send them away to figure out how to pay for treatment on their own. This is absolutely the least productive way to run a practice.

Here’s an example:

Recently, I heard about a man who had a genetic gum tissue degeneration. He had already undergone a gum tissue transplant when he was a young child but now he was likely in need of another one. When his employer offered him dental insurance, he made an appointment with a periodontist to get his gums analyzed.

The dentist determined that the man needed to have tissue grafts on both sides of his upper mouth, which would result in a cost of $3,000 per side or a total cost of $6,000. However, the patient’s dental insurance only paid $1,500 maximum per year, and unfortunately, he didn’t have any funds to pay for the remainder of the balance ($4,500).

The dental office simply gave the patient the information and he left. The office staff didn’t give the patient any options for ways that he might pay the balance. As expected, when the man walked out of the office that day, he felt very discouraged and disappointed. He really wanted and needed the treatment—he knew that it was a critical procedure to get done or he might lose his teeth. However, the patient just didn’t have money in a lump sum to pay for it, so he left without any hope for treatment.

This example shows how a good financial coordinator is crucial to the success of an office. When properly trained, this team player has several financing options available to offer patients. A financial coordinator would never let patients leave without fully discussing all of the options with patients and helping them discover a solution to their financial concerns. By doing so, the financial coordinator and the patient become a team. Together, they analyze the situation and look for different ways to make the financing work. This helps patients feel understood and valued. Therefore, patients will not leave your office feeling discouraged and hopeless, but rather will leave knowing that the dental procedures they both need and want are within their grasp.

A financial coordinator can help patients find money to pay for treatment in many ways. One way (which is my favorite) is through third-party financers. Wells Fargo bank, Chase bank, and Citibank offer these types of options. So does the company, CareCredit, a company that offers a medical credit card specifically for healthcare expenses. CareCredit is generally my first choice. Many of these companies offer no-interest loans that require no down payment. Patients pay for these loans over a set period of time (usually six months to a year) with predetermined monthly payments. The financial coordinator can help patients apply for such programs online, right in the office. That way, they don’t have to go home and try to figure it out solo. Like a credit card application, patients know within minutes whether or not they qualify for the program and how much money has been allotted to them. If patients have a difficult time getting approved, many of these companies will allow applicants to resubmit with a co-signer.

While these types of companies are my preferred way of finding financial assistance for patients, sometimes they just don’t work out. However, even if patients do not qualify for such programs, there still is hope. Here is a list of other options (in order from most desirable to least desirable):

While these types of companies are my preferred way of finding financial assistance for patients, sometimes they just don’t work out. However, even if patients do not qualify for such programs, there still is hope. Here is a list of other options (in order from most desirable to least desirable):

1. Cafeteria Plans. Cafeteria plans are designed to let employees put aside money from their pretax earnings for certain benefits, including dental or medical treatments. Sometimes, employees set up these accounts when they’re hired and then forget that they have them! A Flexible Spending Account is a specific form of a cafeteria plan that reimburses employees for certain qualified benefits.

I find it helpful to jog the memory of patients by asking, “Do you have a Cafeteria Plan or Flexible Spending Account that you could use?” Since the money is intended for medical or dental expenses, it’s obviously one of the first places that patients should draw from to pay for treatment.

2. Family Members or Close Friends. If patients do not qualify for third-party financing, I ask them this question, “Is there any-one who can help?” Sometimes the answer is no. But often, after the patient thinks about it for a few minutes, the answer is yes. Family members and close friends can help out in a variety of ways. They can help by co-signing with the patient for third-party financing. Family members or close friends can also help by giving the patient a gift or loan for some of the money needed for treatment.

3. Loans from Banks or Credit Unions. If the family-member-or-close-friend route doesn’t work, I ask these questions: “What kind of relationship do you have with your bank or credit union? Do you think they might be able to help you?” Bank and credit union loans are often superior to credit cards for one reason—the interest rates are generally lower. Financial coordinators can approach local banks themselves ahead of time, too. Ask the bank manager how the dental practice and the bank can work together to offer financing for patients in the community. Banks are in business to give loans. By helping them fulfill that role, you are also helping your patients and your practice at the same time.

4. Credit Cards. While patients may think of credit cards as the first option for financing, I like to encourage patients to look at all others first. The reason for this is simple: life always has unexpected surprises. I would rather the patients keep their open line of credit on their credit cards available for such situations or emergencies. Plus, credit cards can have interest rates that soar into the 20-percent range. It’s preferable to get interest-free money or low-interest money before this avenue is pursued.

5. Miscellaneous Options. Some patients forgo vacations to get their dental care done. Other patients substitute buying a new vehicle for dental treatments. Still other patients choose to forgo buying a personal item and use that money for the dentistry they need. It’s surprising how with just a little bit of brainstorming, patients can find money from sources that they wouldn’t have initially considered.

6. Home Equity Loans. The last course of action I suggest is that patients look at the possibility of a home equity loan. Like I said, this is my LAST resort. I would never suggest this option at the very beginning of the discussion. After giving this suggestion at one of my seminars, a dentist remarked that he thought I was crazy for even suggesting that patients take a loan out on their house for dental work. Let me re-emphasize, this is a last resort! However, it still is an option and one that I have used in extreme situations.

One situation happened years ago. One of our patients came in with her son. He was 18 years old and had made some very poor choices in his young life. He had cleaned up his act, but as a result of his choices, his teeth were all but destroyed. At only age 18, the young man had his whole life ahead of him. When we discussed his treatment goals, he expressed two simple wishes: he wanted to be able to smile in his senior class photos and he wanted to eventually get a girlfriend. He believed both goals were possible if his teeth were repaired. We tried every financing option available for this family and nothing worked. Finally, we suggested the idea of a home equity loan. The family agreed to try and they were approved for the exact amount of money needed for the treatment.

This particular young man was a member of my community. I cared about him and wanted the very best for him—so did the dentist and his family. We all worked together in a mode of cooperation to help change his life. And I’m proud to say, it worked! The patient was able to get the treatment he needed and because of that, his smile looked fantastic in his senior photos. His renewed confidence gave him the courage to date and eventually find the girlfriend he wanted. Today, he is married and has a child of his own. I love this story because it shows that we really can change lives through dentistry. We really can!

Be a Financial Coordinator Superhero

Not only do financial coordinators need to offer financing options to patients, they also have to work with the patients effectively and proactively. The first key is to always have an enthusiastic and positive attitude when communicating with patients. Let patients know how excited you are to see them. Let them know how fantastic you think the dentist’s treatment program is. Help patients see past the dollar signs and focus on the benefits of the plan.

A good way to help is by getting to know the patients before discussing financing. That way, you can legitimately say (for exam-ple), “Nancy, this treatment that Dr. Roberts has suggested is going to give you the smile you’ve always dreamed of! I’m so excited for you.” You know that having a great smile is something that is important because he or she told you in the initial conversation. Because of that knowledge, you can remind the patient when you’re talking to him or her about the treatment plan. I emphasize again (as in the beginning): make sure to build a relationship with the patients who come into the office. This is so crucial! Really listen to what they have to say. Find out what is important to them. Find out what inspired them to make the appointment. Find out what they hope to achieve.

I remember one of the few times that someone got upset after the doctor presented his comprehensive plan. The patient wasn’t upset about the price. No, he was upset about the fact that the plan didn’t include one of his key issues. He said, “I told that lady when I first came in that my front teeth really bothered me and I wanted them fixed. Why didn’t the dentist include that in my plan?” Had we fully listened to the patient from the beginning, we would have addressed his needs and given him the benefits he desired.

As I mentioned, one of the first goals when helping patients find financing is to get them to stop thinking about the treatment only in terms of dollar signs. The best way to achieve this is by using a formula I learned. It’s pretty simple and it involves value, benefits and cost.

Value = Benefits – Cost

The key to this formula is to make sure that the benefits outweigh the cost. Then, the treatment has value for patients. If it’s the other way around (the cost appears to outweigh the benefits), then the value of the treatment is outweighed by cost concerns and the treatment benefits appear to have little or no value. Benefits (the advantages of treatment) are different for every patient. Some people just want to be able to smile in photos without feeling embarrassed. Other people want to have more confidence for job interviews. Still others are in pain and don’t want to hurt any more.

Such benefits should all be discovered in the initial dialogue with the patients. Pay attention to what is really important to them. That way, when a plan is presented and the dollar signs are mentioned, you can redirect the attention to the benefits of the plan instead of the cost.

Every patient hopes to have a financial coordinator superhero! The financial coordinator is the person who goes to bat for patients and helps them find a way to get the benefits that patients really desire.

Here is a step-by-step guide for financial coordinators to achieve superhero status:

1. Relax the Patient. When discussing finances, always meet in a quiet, private room. Smile and be enthusiastic with your tone of voice. During your conversation, really listen to what the patient has to say. Listen to his or her fears and be proactive in ways to help solve the problems that arise.

2. Ask a Leading Question and Prepare to Respond. Memorize the following question to ask the patient after the dentist pre-sents the treatment plan and leaves the room: “Nancy, tell me, how do you feel about the treatment that Dr. Roberts just presented to you?” Notice, I did not say, “What do you think?” I chose my words intentionally. I want the decision to be about their emotions, so that is why I ask them how they feel. I focus on feelings because the are tied directly to emotions.

3. Quote the Fee and Respond. Now that the patient understands the treatment plan and has expressed his or her feelings about it, then I quote the cost of the plan. I do this in a very specific way. For example, “Nancy, if you had an appointment today to get this treatment done, (you don’t but if you did,) it would be $17,740.” After I quote the fee, I always wait three seconds without saying anything. If the patient doesn’t respond, then I ask this question: “Did this surprise you, Nancy?” Generally, the answer will be “yes.” If so, then I ask, “Is it the treatment that surprised you?” The patient will often (about 499 times out of 500) reply with, “Oh no, it’s the money.” Then I respond, “You’re saying that if we can figure out how we can fit this into your budget, then this is something that you’d like to have?” The patient will almost always answer with, “Oh yes, Tawana! I want this so badly.”

4. Empathize Instead of Sympathize with the Patient. This is your chance to show that you truly care about the patient. When I empathize with patients, I understand things from their perspective. At this point, whatever the patients say regarding the money, you can tell them that you totally understand and that you are going to work together to see if you can figure out a solution. You want this for your patients too! You want them to have all the benefits of the treatment plan so their lives can improve.

5. Explore Payment Options. At this point, run through the list of payment options with the patient. You should always start with the third-party financing options as described above and move down the list from there.

6. Listen with Your Heart and Patients Will Know You Care. Whenever I’m working with patients, I always listen with my heart and my head. This helps the patient know that they have an ally; that it’s not you against them and that you’re not trying to take their money. You’re trying to help them change their life with an amazing comprehensive dental plan. The patient always needs to know that you care. Everyone wants to have a superhero—someone who can rescue him or her from difficult situations. The financial coordinator can truly become that superhero for the patients as together they discover ways to make this treatment plan financially feasible.

7. Always Give the Patients Hope. As a good financial coordinator, you always want your patients to leave your dental office with hope. Even if you have gone through every possible scenario with them and there is still no way to find funding for the comprehensive treatment, you still want them to know that you care about them and you believe in them. When I find patients in this predicament—they have exhausted all resources and have not been able to find funding—I tell them, “Don’t give up hope. We’ll get there. It might take longer than we might want it to, but we’ll get there. Just remember, you NEVER know when your circumstances are going to change.” No matter what happens, always keep such patients in your recall system and have hope that someday they’ll be able to get the treatment that they both need and want.

Answering Financial Questions

Answering Financial Questions

Helping patients figure out the answer to the question, “How can I possibly pay for this?,” doesn’t have to be a mystery or a challenging process. With proper training, the financial coordinator can use a variety of methods to help patients find the funding that they need. This crucial member of the dental team can make sure that every patient who leaves the dental office feels hope that a bright dental future is on the horizon. It’s possible to do this for each and every one of the patients who come into your office. It really is!

CLICK HERE to read Dr. Dick Barnes’s article, “The Dental Insurance Conundrum” from our Spring 2014 Issue, for further understanding why dental insurance shouldn’t be the only method of payment.