Managing PPO Memberships and Associated Agreements.

Today, dental insurance companies are working aggressively to expand their network footprints to include more dentists and more locations. According to the Life Insurance and Market Research Association (LIMRA), a worldwide association of insurance and financial services companies, dental insurance is the third most requested employee benefit, after health insurance and retirement.

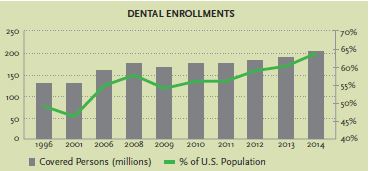

In addition, the American Dental Association (ADA) reports that in 2015, nearly 73 percent of all dental patients had a dental benefit. This statistic shows that more people have dental benefits than ever before. The chart, below right, shows the growth in dental insurance enrollments, as well as the percentage of the United States population with dental insurance coverage. Both enrollments and coverage are at an all-time high.

As the number of people with dental benefits has increased, insurance participation has grown in popularity among dentists. Most dentists now participate as a preferred provider in at least one dental network. In fact, more dentists participate in more plans than ever before.

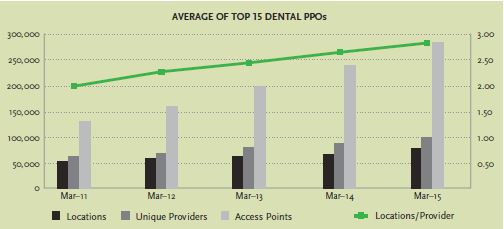

According to the Delta Dental Plans Association, “Nationally, about 80 percent of dentists participate in one or more Delta Dental Programs.” Recent data from NetMinder, a tool that analyzes data and is powered by the healthcare consulting group, The Ignition Group, suggests that participation is increasing widely. The chart to the right shows the increase in the number of locations, providers, and access points among the top dental networks. The data in the graph suggests that more dentists are in networks, more dentists are part of more plans, and more dentists are contracted at more locations.

The growth of Preferred Provider Organizations (PPOs), such as Delta Dental®, and their heightened importance within most dental practices has resulted in one of the most dramatic changes in the history of the profession: Dentists no longer control pricing power to the extent previously exercised, and margins are under siege, based on insurance reimbursement schedules. As this trend advances, it is important to realize that insurance companies continue to evolve their cost-containment tactics.

Dental plans are structurally designed to subsidize the cost of care within the confines of the total amount of premiums collected. Because of this, most aspects of a dental plan are designed to contain costs. Common cost-containment tactics include downcoding to an alternate benefit, waiting periods, and frequency limitations on visits. While PPO participation remains a viable way to attract and retain patients, dentists need to be increasingly aware of the ever-changing strategies that PPOs use to contain costs.

Network-Sharing Agreements

One of the more creative ways that insurance companies have evolved their methods for managing costs is the introduction of network-sharing agreements. A network-sharing agreement is an agreement that allows a dental network access to dental providers from another network, thereby increasing the number of “in-network” providers who are available.

Over the past few years, insurance companies, dental networks, and third-party administrators (TPAs) have partnered together to multiply the size of their dental networks. The most common example is GEHA (Government Employees Health Association) Connection Dental® Network. By joining Connection Dental®, dental providers can participate as in-network providers for over 60 insurance associations, TPAs, etc.

As insurance company network-sharing agreements proliferate, it is becoming increasingly difficult for office staff to communicate to patients whether or not they are in-network. Furthermore, it is difficult to estimate patient payments when offices don’t have a strong understanding of which fee schedule they will be paid from.

The Best Interest of the Member

To complicate matters further, several carriers have started to change the way they administer dental plans. These carriers base their payments on the lowest of the partner fee schedules. Despite a signed contract based on a specific fee schedule, several insurance companies pay according to partnership agreements if the fee is lower.

You may wonder how insurance companies can legally justify this action. However, most insurance carriers have language in their contracts with each provider that allows them to make changes that are in the best interest of the member (a member is simply a person with insurance). Reimbursing the provider at a lower fee benefits the member.

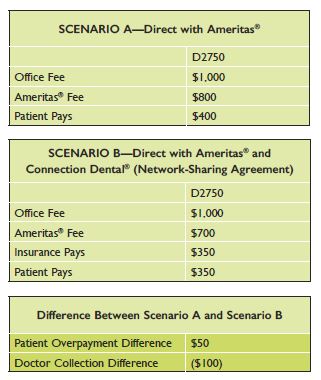

In the hypothetical example below, a dentist is contracted with the insurance company Ameritas®, as well as participating in Connection Dental®. Historically, a direct contract resulted in a claim being paid according to the directly contracted rate from Ameritas® (see scenario A). This fee was confirmed via claims in February of 2015. In 2016, however, Ameritas® paid out claims according to the lower Connection Dental® fee schedule (see scenario B). The result is that the doctor’s net collection is $100 less than what was contracted directly with Ameritas®.

Is this a Big Problem?

There are several problems with this strategy. First, the dentist makes less money than anticipated due to differences between the insurance company fees. Second, the dental office is likely not collecting the appropriate patient portion in light of the reimbursement differences. In the example provided, the patient saves $50 in out-of-pocket costs between example A and B. In many other circumstances, the difference is often much less noticeable. Therefore, the office may be writing off small balances created by this change or have more credits to issue than normal. The reimbursement difference for a D0120 (periodic evaluation) in our claims study was $1. However, if you multiply these small write-offs across the entire practice, you are potentially dealing with a significant amount.

Network-sharing agreements (also called leasing agreements) have advantages and disadvantages for dentists. Here are a few:

ADVANTAGES

Access to potential patients

Deciding to participate in-network with a company and its leased partners expands access to a larger membership base. More people with a PPO will find you in-network as a result of shared network agreements. This creates the potential for practices to better attract and retain patients.

Compensation differences

Compensation for services might be higher in a particular leased network than would be available by contracting directly. Evaluating this difference is critical to making informed choices about network participation. Five Lakes Professional Services, the company I started and lead, uses this strategy situationally to increase reimbursements for clients. We call it contract optimization—when a company has multiple partnerships that generally offer a higher fee schedule than what you can get by contracting directly. Through network-sharing agreements, offices are not considered in-network for 100 percent of a practice’s membership, but the resulting improvement in reimbursement rates may present an attractive alternative. In my experience, very few dental offices employ this tactic, and in so doing, leave potentially large sums of revenue unrealized.

Simplified practice administration

Contracting across multiple plans with a single point of contact and a single fee schedule simplifies insurance management in the dental practice.

DISADVANTAGES

Compensation differences

Just as network-sharing agreements may present an opportunity to participate in higher reimbursing fee schedules, providers can also lose money when they become contracted through network-sharing agreements unexpectedly. This happens for two main reasons. First, the existence of and extent of network partnerships is still largely unpublished (more on lack of transparency in the next section).

Second, several insurance companies have started using the lower of their partners’ fee schedules to reimburse participating providers. Therefore, the existence of more network partnerships may one day result in carriers finding the lowest common fee schedule and moving to payment from that schedule.

Lack of transparency

As previously mentioned, many insurance companies simply don’t know (or don’t disclose) all the details of their leased arrangements. For example, when you contract in Guardian® dental insurance via a network-sharing agreement with DenteMax (a PPO network), DenteMax representatives do not know or may not disclose the specific Guardian® plans or groups that are provided access through the DenteMax network.

Connection Dental® provides the following disclaimer on their payor list, “Not all dental offices participating with the Connection Dental® network will be considered in-network for all groups listed. Please contact them to verify participation.“

Maverest Dental Network, formerly under the direction of Dr. Cheryl Lerner, has made a tremendous effort to create transparency around their partners. However, most carriers still provide only limited information.

Ultimately, this means that providers may join a network without necessarily knowing it, thereby bringing patients in-network unintentionally.

Lastly, leasing often creates overlap. Leasing a network is when “Network A,” for example, has a network-sharing agreement to access “Network B’s” unique providers. This occurs when a network like Guardian® group dental insurance establishes multiple lease partners. When there is network overlap, a proprietary set of rules determines in many cases how the partners will identify your relationship.

Billing and patient communication confusion

As mentioned, many insurance companies have extensive reach within their leased partners, creating confusion about contracting status and fee schedules. Determining when to bill in-network, what to tell patients, and how much to collect for the patient portion becomes more difficult in many leasing arrangements.

As a dentist, evaluating the pros and cons of network-sharing agreements is an important step in developing and managing your insurance participation strategy.

Successfully navigating insurance requires more and more frequent evaluation. Awareness of cost-containment behaviors like network-sharing agreements can better position your practice to provide quality care profitably. Knowing what data you need to access is critical in order to keep your patients happy and your fee schedules within the plans that pay at the highest levels of return.

Five Tips to Stay Ahead

It’s likely insurance companies will find the lowest fee schedule through which to reimburse a provider. Therefore, it is important for dental office management to take the following measures to avoid any surprises:

1. Verify benefits. Always check insurance benefits before treating a patient.

2. Understand your agreements. Ask questions and keep asking until there is a thorough understanding of what impact there might be on payments when changes occur to the provider’s contracting status (as a result of a new partnership or other factors). As partnerships change, look at the positive or negative financial impact on your insurance portfolio.

3. Learn about potential effects. Be educated on the aspects of membership that have potential for contractual changes. Pay attention to external influences (such as legislation and market competition) that may result in carriers making changes to your plan’s administration.

4. Take action! Equip yourself with knowledge and prepare to take action if something isn’t adding up, or work with a professional PPO management firm to help oversee your PPO participation.

5. Develop, discover, and deploy. Several influential factors should be collected and monitored on a regular basis in order to maximize profitability in the various PPO plans that you participate in. Discover, develop, and deploy an insurance participation strategy appropriate to the goals of your dental practice. Properly managing such PPO plans can truly have a dramatic impact on the profitability of your P&L statement year after year.